Why you need Insurance Broker?

General

Who is Insurance Broker?

- An insurance broker is a specialist in insurance and risk management.

- Brokers act on behalf of their clients and provide advice in the interests of their clients.

- A broker will help you identify your individual and/or business risks to help you decide what to insure, and how to manage those risks in other ways.

- Insurance brokers can give you technical advice that can be very useful if you need to make a claim.

- Brokers are aware of the terms and conditions, coverage’s and exclusions and costs of a wide range of competing insurance policies, so they can help you find the most appropriate cover for your own circumstances.

- Brokers can help arrange and place the cover with the chosen insurer.

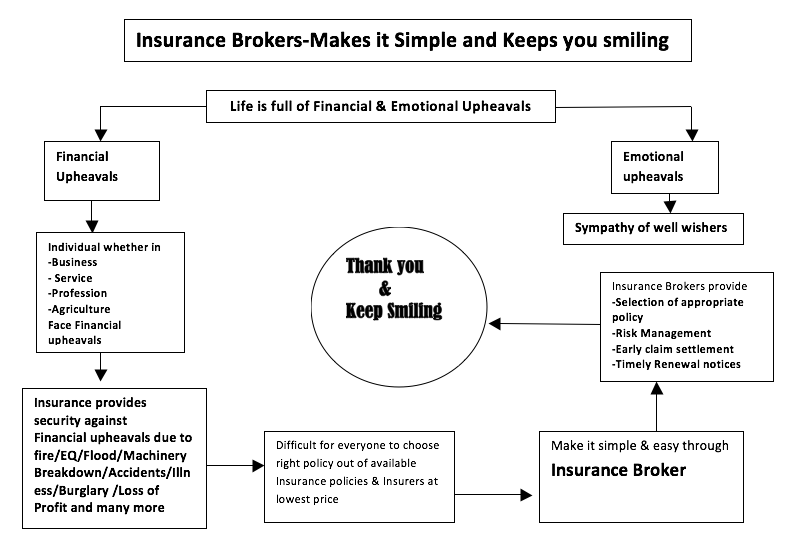

Why use a broker?

- Some insurance policies can be complicated, and an insurance broker can help you understand the details of a policy and also work out what level of cover you need, so that you can make sure you are properly protected.

- Brokers can often find you a good deal on insurance because they have a thorough understanding of the insurance market and can negotiate premiums on your behalf.

- A broker will explain your policy to you and advise you if there are any special situations you need to know about.

- Brokers can prepare a customised insurance and risk management program for you or your business, where they design the policies, negotiate the terms with insurance companies and place the cover with the insurer.

- By including a risk management program, which puts some of the responsibility for risk prevention and loss minimisation on you or your business, you can reduce premium costs.

- Using the broker doesn’t cost more than going direct as they are paid the brokerage by the Insurers for selling their products.

- If you need to make a claim on your policy, your broker will assist you through the process and will liaise with the insurer on your behalf.

Can your broker help you make a claim?

Yes, it is one of the functions of the broker without charging any fees. In case the business is placed directly and you need the broker assistance to negotiate and preparation of documents , he is entitled to charge fees.

What sort of questions should you ask your broker?

“Consensus ad item” of any business partnership is success key of for both the parties. It is advised that the following questions may be asked before entering into any partnership:

- The broker’s qualifications

- The range of services

- Who would service your account

- Experience with your type of business

- The size of the broker’s typical client

- References from satisfied clients

- Level of commitment

- How the brokerage proposes to solve your insurance problems

Locate the broker

On this website “Tab” locate the broker is available click it and fill the name of the city where you need broker. The list of brokers in that city will appear.